|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

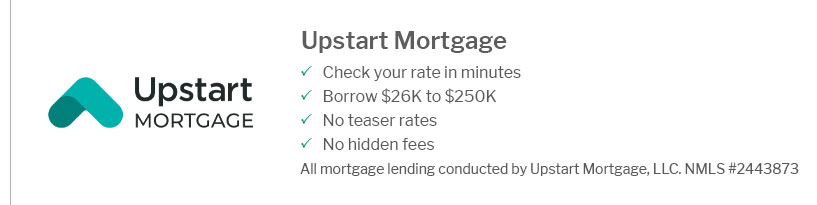

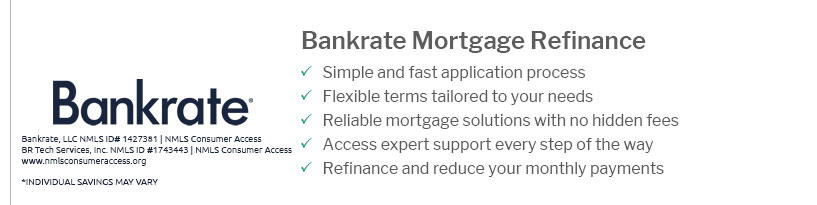

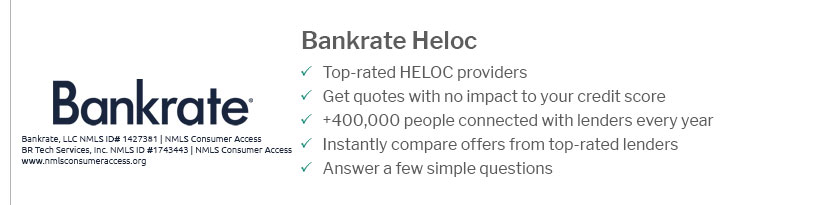

Best Refinance Companies for Self Employed: A Comprehensive GuideRefinancing can be a savvy financial move for self-employed individuals, offering the potential for lower interest rates and more favorable terms. However, the process can be more complex due to variable income streams and unique financial documentation. This guide explores top refinance companies that cater specifically to self-employed borrowers. Top Features to ConsiderWhen selecting a refinance company, self-employed individuals should consider several key features to ensure they find the best fit for their needs. Flexible Income VerificationOne crucial aspect is the company's approach to income verification. Look for lenders that offer flexibility in assessing income documentation, such as accepting bank statements or profit and loss statements in lieu of traditional pay stubs. Competitive Interest RatesInterest rates are a primary consideration for refinancing. It's essential to compare rates from different companies to ensure you secure the most competitive offer available. Customer ServiceQuality customer service can greatly impact the refinancing experience. Look for companies with strong customer reviews and a reputation for supporting self-employed borrowers through the process. Notable Refinance CompaniesHere are some refinance companies that stand out for their self-employed borrower services:

Tips for Self-Employed BorrowersBefore refinancing, self-employed individuals should prepare by organizing financial documents and understanding their credit profile. Utilize online tools like a calculator home loan refinance to estimate potential savings and costs. FAQs

ConclusionFor self-employed individuals, choosing the right refinance company involves considering flexible income verification processes, competitive interest rates, and excellent customer service. By carefully assessing these factors and preparing necessary documentation, self-employed borrowers can successfully navigate the refinancing landscape. https://www.benzinga.com/money/mortgage-lenders-for-self-employed

Quick Look: Best Mortgage Lenders for Self-Employed - Best for Competitive Rates: Angel Oak Mortgage Solutions - Best for Bank Statement Home ... https://defymortgage.com/learn/the-top-15-self-employed-mortgage-lenders/

In this guide, we'll be showcasing lenders who understand the unique income structures of the self-employed and who can help you achieve your homeownership ... https://griffinfunding.com/non-qm-mortgages/self-employed-refinance/

With our bank statement loan (BSL) cash-out refinance, self-employed borrowers can qualify based on bank statements rather than traditional income documentation ...

|

|---|